Executives deal in children and real estate

Officers buy property, sell it to foster-care agency

By Debra Jasper and Elliot Jaspin DAYTON DAILY NEWSPublished: Sunday, September 26, 1999

Sidebar to Part 1

LIMA - Running a multimillion-dollar private foster-care agency has brought

its president, Bruce Maag, recognition among his peers.

It has also brought him something else - money.

In addition to receiving a $130,000 yearly salary, bonuses and other

incentives, a Dayton Daily News investigation found that Maag and another

high-ranking company official appear to have profited by dealing with their

own agency.

In addition to receiving a $130,000 yearly salary, bonuses and other

incentives, a Dayton Daily News investigation found that Maag and another

high-ranking company official appear to have profited by dealing with their

own agency.

Maag declined comment, but Steve Mansfield, an attorney and SAFY official, defended the land deals. Mansfield said SAFY did not pay above-market rates.

State officials, however, say agency executives should not benefit from dealing with their own nonprofit organizations.

`If the manager of a nonprofit is buying and selling property to that nonprofit, I'd say there is a lot of self-dealing going on,' said Ohio Auditor Jim Petro. `That would potentially be an abuse of public funds.'

Amy Rohling, acting director of the Ohio Association of Non Profit Corporations, also questioned the propriety of selling property to your own agency.

`It does not seem ethical or appropriate to engage in business, to personally profit, because of your relationship with the nonprofit you are affiliated with,' she said.

Maag is well known within the foster-care industry. In addition to SAFY, he also heads the National Institute for Alternative Care Professionals, which trains foster-care professionals throughout the country.

Less known are Maag's property transactions, some of which blur the line between Maag as agency director and Maag as businessman.

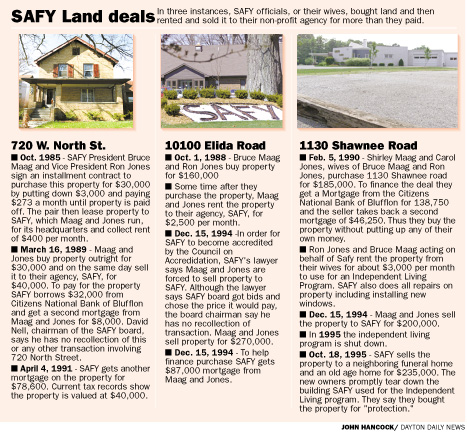

In October 1985, Maag and Jones purchased an unpretentious two-story brick house on West North Street in Lima for $30,000, records show.

They put down $3,000 and agreed to pay the seller $273 a month until the building was paid off. Maag and Jones then rented the building to SAFY as its headquarters for $400 a month.

"If the manager of a nonprofit is buying and selling property to that nonprofit, I'd say there is a lot of self-dealing going on. That would poten- tially be an abuse of public funds."

JIM PETRO

|

* On March 16, 1989, Maag and Jones paid off the original owners and obtained clear title to the building. As detailed in the 1985 agreement, the purchase price was $30,000.

* As the owners of the North Street property, Maag and Jones then sold the property on the same day to SAFY for $40,000.

* To finance the purchase, SAFY took out a loan of $32,000 from the Citizens National Bank of Bluffton, and Maag and Jones loaned SAFY $8,000 to cover the balance of sale.

At first blush it would appear Maag and Jones made $10,000 in a matter of minutes by selling their property to their nonprofit corporation. But Mansfield, SAFY's attorney, said this is not the case.

Mansfield first said Maag and Jones actually paid $40,000 for the North Street property, even though the conveyance fee on the deed indicates $30,000.

"That figure there may not be an accurate figure," Mansfield said, referring to the conveyance fee. He then acknowledged he did not know for a fact if the conveyance was accurate, but he was certain that Maag and Jones bought the property for $40,000 and then sold it for the same amount.

How did he know this?

Mansfield said that Jones told him that "many moons ago and again this morning."

At a second interview, Mansfield acknowledged that Maag and Jones did indeed buy the property for $30,000 and sell it the same day for $40,000, but he insisted they did not make a profit. The reason: They had to sink substantially more than $10,000 into the building in repairs during the four years they owned it and were renting it to their agency, he said.

David Nell, the SAFY board chairman, could not recall the North Street purchase. But he said the fact that Maag sold property to his own agency "does not raise any questions with me."

"If it did happen," he said, "I'm sure it was all perfectly legal."

In 1990, a year after SAFY bought the North Street property from Maag and Jones, their wives bought an abandoned schoolhouse on Shawnee Road. They soon started renting the property to SAFY, then sold it to SAFY almost five years later for $15,000 more than they paid originally.

By the late 1980s, SAFY was expanding rapidly and in need of additional office space. Again, Maag and Jones would figure in a property transaction.

Courthouse records show that the pair bought a former church on Elida Road in Delphos for $160,000 in 1988.

Shortly after the purchase, Maag and Jones began renting the building to SAFY for what Mansfield guessed was $2,500 a month.

Maag's role as landlord came to an end in December 1994 after SAFY invited the Council on Accreditation to inspect the agency. According to Mansfield, the council sent SAFY a clear message: If you want to win accreditation, you must end your business ties with your president.

"(Accreditation) did cause the sale of the Elida Road property . . . because of Maag ownership," said Mansfield, who also acknowledged that the council forced the sale of the old schoolhouse on Shawnee Road.

Mansfield said the SAFY board of directors formed a committee to determine the fair market value of the property on Elida Road, the company's new headquarters. Although Mansfield said that Nell, SAFY's board chairman, headed the committee, Nell declined to give specifics about the deal .

Mansfield said the committee consulted several appraisers to determine the value of the property and then "laid it on the table": Maag and his partner would accept $270,000 - a 68 percent increase above the original purchase price.

|

Main Story:

Children often the last to benefit

Difficult kids flood system as government oversight vanishes

By Debra Jasper and Elliot Jaspin DAYTON DAILY NEWS

Published: Sunday, September 26, 1999 ; Page: 1ASidebar:

AGENCY PRESIDENT STAYS IN CHARGE DESPITE CONVICTION

Juvenile justice's confidentiality blanket covers record

By Debra Jasper, Elliot Jaspin; and Mike Wagner DAYTON DAILY NEWS

Published: Sunday, September 26, 1999 ; Page: 18APart 2:

Living site turned into party house

Former residents say teens had little supervision in foster-care program

By Debra Jasper and Elliot Jaspin DAYTON DAILY NEWS

Published: Monday, September 27, 1999 ; Page: 1A